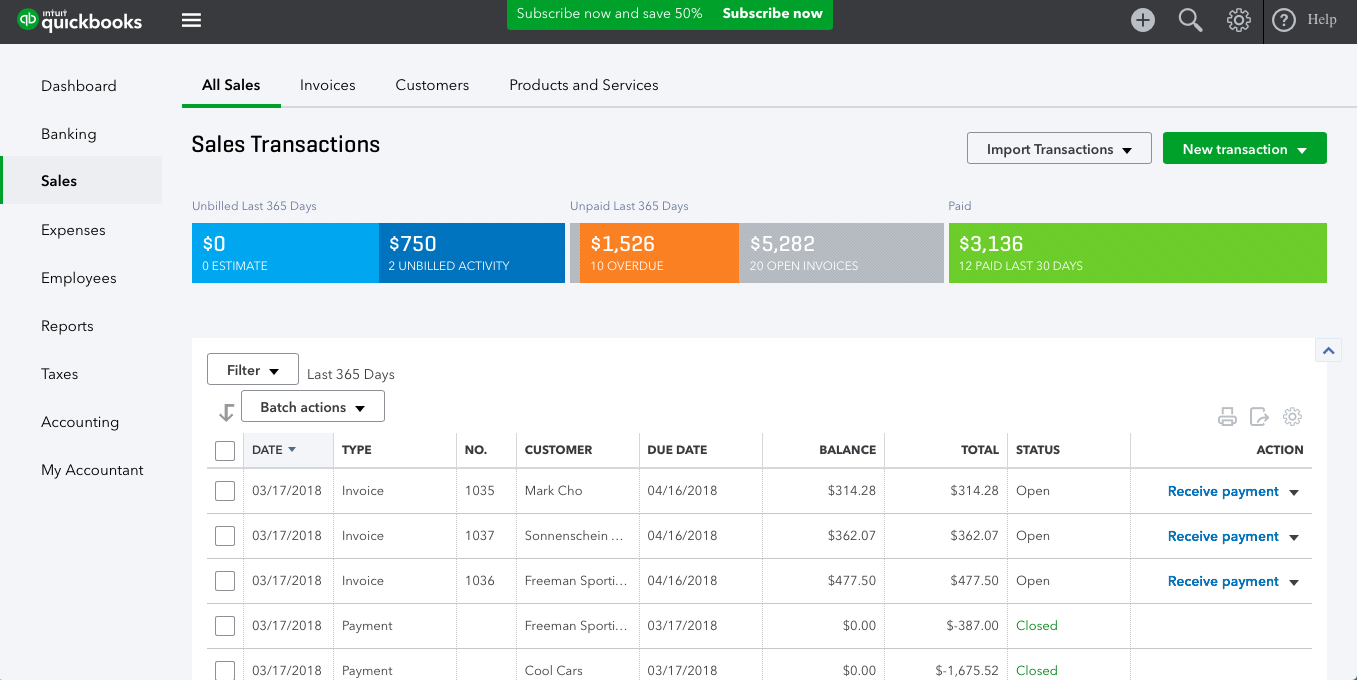

Select the bank account, then click View register. Heres how: Click Accounting, then go to the Chart of Accounts tab.

When you undo a reconciliation, youll have to edit each transaction.

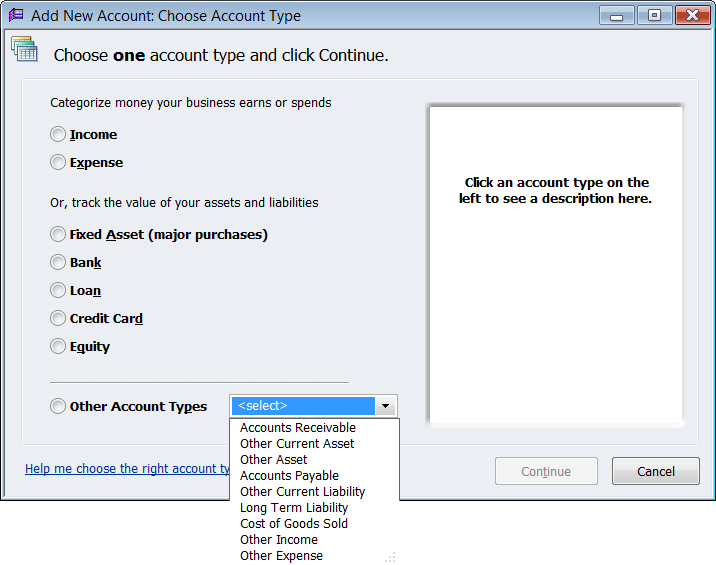

Displays the list of terms that determine the due dates for payments from. This way, QuickBooks Online will recognize the accurate and new balance. Where do you enable account numbers for the QuickBooks online chart of accounts. The due from account falls into the latter category. Having said that, well have to unreconcile and reconcile the previous period again. In it, investors will find credit and debit accounts. Both accounts can, however, be zero.Ī general ledger stores and organizes data, providing a record of every financial transaction that takes place during the life of an operating company. It is the amount of funds due to another party and is found in the general ledger. Due from accounts and due to accounts should never be negative, which would signify bad data. Due to Account is an accounting term that denotes a liability account.Nostro accounts are a type of due from account that are used to facilitate foreign exchange and trade transactions.Due from accounts are used to separate incoming and outgoing funds, making accounting easier, particularly for audits.Due from accounts focus on incoming assets, also known as receivables, while the due to accounts focus on outgoing assets, also called payables.The due from account is typically used in conjunction with a due to account.To review your app settings, open Apps from the left menu, locate your App and select Settings.

In this blog, we will discuss the errors that arise due to small balances as a result. The difference between the Invoice amount and the advanced amount, in our example 2000, needs to be applied to the Due From Factor account. In addition to returning the transactions to the For Review tab, where you can categorize them, I recommend checking your app settings, to ensure a smooth transition into QuickBooks Online. QuickBooks records these transactions to the Accounts Payable account. Account Template Customize 1260 Memberships. A due from account tracks assets owed to a company and is not used for the tracking of any liabilities or obligations. Hi marishamazurekbiz, Thanks for joining us here. due in 60 days ( substitute your own interval if you don't work on a 60.A due from account is a debit account that indicates the number of deposits currently held at another company.

0 kommentar(er)

0 kommentar(er)